Best Credit Union To Refinance Student Loans

Top Credit Unions for Refinancing Student Loans

Hey there, are you feeling overwhelmed by your student loan payments? Refinancing your student loans with a credit union can be a great option to help you save money and simplify your finances. In this article, we will explore some of the top credit unions that offer refinancing options for student loans, making it easier for you to manage your debt and achieve financial freedom. Let’s dive in and find the perfect credit union for your needs!

Benefits of Refinancing Student Loans at a Credit Union

Refinancing student loans at a credit union can offer a variety of benefits that can make managing your debt easier and more cost-effective. One of the primary benefits of refinancing student loans at a credit union is the potential for lower interest rates. Credit unions are not-for-profit financial institutions, meaning they often offer lower interest rates on loans compared to traditional banks. By refinancing your student loans at a credit union, you may be able to secure a lower interest rate, which can ultimately save you money over the life of your loan.

In addition to potentially lower interest rates, credit unions also tend to offer more flexible repayment options for student loan refinancing. Unlike traditional banks, credit unions are typically more willing to work with borrowers to create a repayment plan that fits their individual financial situation. This can include options for income-based repayment plans, deferment, or forbearance in case of financial hardship. By refinancing your student loans at a credit union, you may be able to find a repayment plan that works better for you and your budget.

Another benefit of refinancing student loans at a credit union is the personalized customer service you are likely to receive. Credit unions are known for their focus on customer satisfaction and building relationships with their members. When you refinance your student loans at a credit union, you can expect to work with knowledgeable loan officers who can help guide you through the process and answer any questions you may have. This level of personalized customer service can make the refinancing process smoother and less stressful.

Furthermore, credit unions are often more willing to work with borrowers who may have less-than-perfect credit histories. If you have struggled to make payments on your student loans in the past, refinancing at a credit union may be a good option for you. Credit unions are typically more willing to look at the bigger picture of your financial situation, rather than just focusing on your credit score. By refinancing at a credit union, you may be able to secure better loan terms, even if your credit history is not pristine.

In conclusion, refinancing your student loans at a credit union can offer a range of benefits that can make managing your debt easier and more affordable. From lower interest rates to more flexible repayment options and personalized customer service, credit unions provide a unique and borrower-friendly approach to student loan refinancing. If you are looking to save money on your student loans and find a repayment plan that works for you, consider refinancing at a credit union.

Factors to Consider When Choosing a Credit Union for Student Loan Refinancing

Refinancing student loans can be a great way to lower your interest rates and monthly payments. However, not all credit unions are created equal when it comes to student loan refinancing. When choosing a credit union to refinance your student loans, there are several factors you should consider.

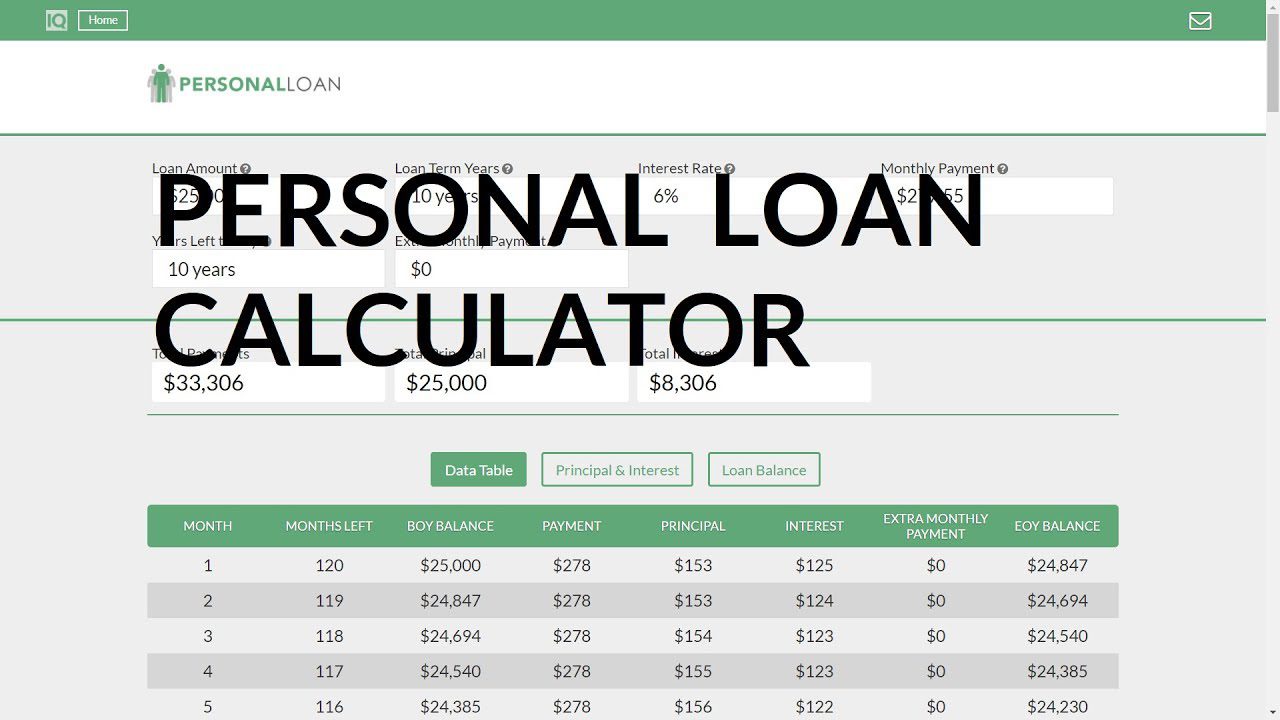

One important factor to consider is the interest rate offered by the credit union. The interest rate will determine how much you will pay in total over the life of the loan. It is important to shop around and compare interest rates from different credit unions to ensure you are getting the best deal. Look for credit unions that offer competitive rates and potentially even lower rates than traditional banks.

Another important factor to consider is the repayment terms offered by the credit union. Some credit unions may offer flexible repayment options, such as income-driven repayment plans or deferment options. These options can be helpful if you are struggling to make payments or if you anticipate changes in your financial situation in the future. Make sure to ask about the repayment terms offered by the credit union before refinancing your student loans.

In addition to interest rates and repayment terms, you should also consider the customer service provided by the credit union. Refinancing your student loans can be a daunting process, and it is important to choose a credit union that is responsive and helpful. Look for credit unions that have good customer reviews and a reputation for excellent customer service. A credit union that is willing to work with you and answer any questions you may have can make the refinancing process much smoother.

Lastly, consider the eligibility requirements for refinancing student loans at the credit union. Some credit unions may have strict eligibility requirements, such as a minimum credit score or income level. Make sure you meet the eligibility requirements before applying for student loan refinancing at a particular credit union. If you do not meet the requirements, you may be denied or offered less favorable terms.

In conclusion, when choosing a credit union for student loan refinancing, it is important to consider the interest rate, repayment terms, customer service, and eligibility requirements. By taking the time to research and compare different credit unions, you can ensure you are getting the best deal on your student loan refinancing. Remember to weigh all factors carefully before making a decision and choose a credit union that meets your needs and financial goals.

Top Credit Unions for Refinancing Student Loans

Refinancing your student loans can be a great way to save money on interest and potentially lower your monthly payments. If you’re considering refinancing your student loans with a credit union, here are some of the best options available to you:

1. PenFed Credit Union: PenFed Credit Union offers competitive rates on student loan refinancing, making it a popular choice among borrowers. They offer both fixed and variable rate options, as well as flexible repayment terms. Additionally, PenFed Credit Union has a reputation for excellent customer service, making the refinancing process as smooth as possible for borrowers.

2. Navy Federal Credit Union: Navy Federal Credit Union is another top choice for student loan refinancing. They offer competitive rates and flexible repayment terms, making it easy for borrowers to find a loan that fits their needs. Navy Federal Credit Union also offers special benefits for military members and their families, including lower interest rates and waived fees.

3. Alliant Credit Union: Alliant Credit Union is a great option for borrowers looking to refinance their student loans. They offer competitive rates, flexible repayment terms, and excellent customer service. One of the benefits of refinancing with Alliant Credit Union is their Member Advantage program, which offers discounts on loan rates for members who have direct deposit or an Alliant checking account. This can help borrowers save even more money on their student loan refinancing.

Overall, credit unions can be a fantastic option for refinancing your student loans. They often offer competitive rates, flexible repayment terms, and excellent customer service, making the refinancing process as easy and stress-free as possible. Consider reaching out to one of these top credit unions for student loan refinancing to see how much you could save on your loans!

How to Apply for Student Loan Refinancing at a Credit Union

When it comes to refinancing your student loans, credit unions can be a great option to consider. Credit unions typically offer competitive interest rates and flexible repayment terms, making them an attractive choice for borrowers looking to save money on their student loans. If you’re interested in refinancing your student loans at a credit union, here’s how you can get started:

1. Do Your Research: Before applying for student loan refinancing at a credit union, it’s important to research different credit unions and compare their rates and terms. Look for credit unions that specialize in student loan refinancing and have a good reputation for customer service. You can also check online reviews and talk to current members to get a better understanding of the credit union’s offerings.

2. Gather Your Documents: Before you apply for student loan refinancing at a credit union, you’ll need to gather important documents such as your current loan statements, proof of income, and identification. Having these documents ready will help streamline the application process and expedite approval.

3. Fill Out the Application: Once you’ve chosen a credit union to refinance your student loans, you’ll need to fill out an application form. The application will typically require information about your current student loans, employment status, income, and financial history. Make sure to fill out the application completely and accurately to avoid any delays in the approval process.

4. Submit Additional Documents: In addition to the application form, you may be required to submit additional documents to support your refinancing application. These documents may include bank statements, tax returns, or proof of graduation. Providing these documents promptly will help speed up the approval process and increase your chances of getting approved for refinancing.

5. Review and Accept the Terms: Once your application is submitted and approved, the credit union will provide you with a loan offer detailing the interest rate, repayment term, and monthly payments. Take the time to review the terms of the loan carefully and make sure you understand all the details before accepting the offer. If you have any questions or concerns, don’t hesitate to reach out to the credit union for clarification.

6. Sign the Loan Agreement: If you’re satisfied with the loan offer, you can proceed to sign the loan agreement. By signing the agreement, you’re committing to repaying the loan according to the terms outlined by the credit union. Once the agreement is signed, the credit union will disburse the funds to pay off your existing student loans, and you’ll begin making payments on the new refinanced loan.

Applying for student loan refinancing at a credit union can help you save money on interest and simplify your repayment process. By following these steps and being prepared with the necessary documents, you can increase your chances of getting approved for refinancing and enjoy the benefits of lower monthly payments and potentially shorter repayment terms. Reach out to your local credit union today to learn more about their student loan refinancing options and start the application process.

Tips for Successfully Refinancing Student Loans with a Credit Union

Refinancing student loans with a credit union can be a smart move for many borrowers looking to lower their interest rates or monthly payments. However, it’s important to approach the process strategically in order to ensure a successful outcome. Here are some tips to help you navigate the refinancing process with a credit union:

1. Do your research: Before deciding to refinance your student loans with a credit union, take the time to research the different options available to you. Compare interest rates, terms, and benefits offered by different credit unions to find the best fit for your financial goals.

2. Check your credit score: Your credit score will play a significant role in determining the interest rate you qualify for when refinancing your student loans. Before applying for refinancing, check your credit score and take steps to improve it if necessary. A higher credit score can help you secure a lower interest rate, saving you money in the long run.

3. Gather necessary documents: When applying to refinance your student loans with a credit union, you will need to provide certain documents, such as proof of income and existing loan information. Gather these documents in advance to streamline the application process and increase your chances of approval.

4. Consider a cosigner: If you have a limited credit history or a low credit score, a cosigner with a strong credit profile can help you qualify for a lower interest rate when refinancing with a credit union. Talk to potential cosigners about the responsibilities and risks involved before moving forward with the application.

5. Communicate with your credit union: Once you’ve submitted your application to refinance your student loans with a credit union, stay in communication with your loan officer throughout the process. Be proactive in providing any additional information or documentation requested, and ask questions if you’re unsure about any aspect of the refinancing process.

By following these tips and approaching the refinancing process with a credit union strategically, you can increase your chances of successfully lowering your interest rates and monthly payments on your student loans. With careful consideration and thorough research, refinancing with a credit union can help you take control of your student loan debt and improve your financial outlook.