Refinance Private Student Loans

Refinance Private Student Loans

Hey there! Are you finding it difficult to keep up with your private student loan payments? Refinancing your private student loans might be the solution you’ve been looking for. By refinancing, you could potentially lower your interest rate and monthly payments, making it easier to manage your debt. Let’s explore the ins and outs of refinancing private student loans and how it could benefit you.

What is Refinancing?

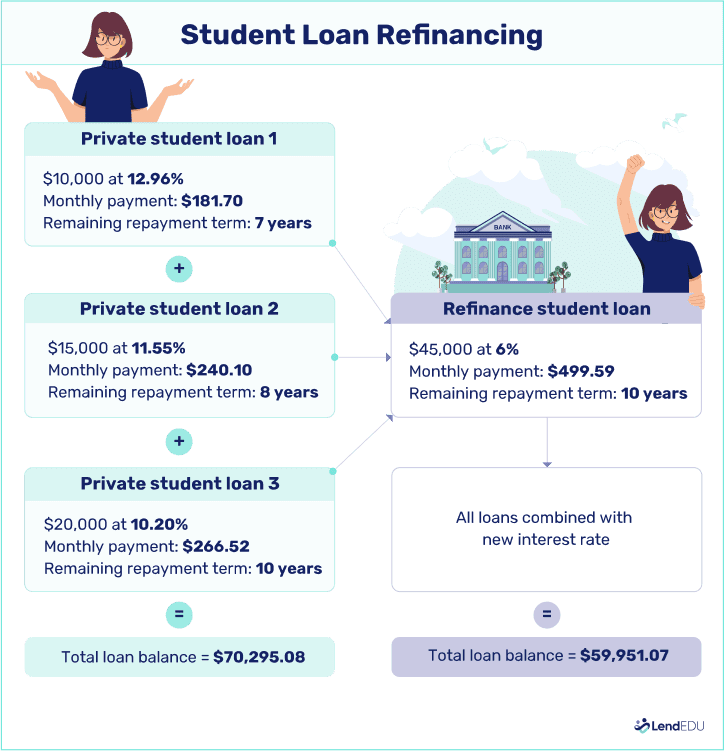

Refinancing private student loans is a process where a borrower takes out a new loan to pay off existing private student loans. The new loan typically comes with a lower interest rate, different repayment terms, and may offer other benefits such as a longer repayment period or the option to consolidate multiple loans into one. This can help borrowers save money on interest payments over time and may also make their monthly payments more manageable.

When you refinance your private student loans, you essentially replace your existing loans with a new loan from a different lender. This can be beneficial if you are currently struggling to make payments on your loans or if you are looking to save money in interest fees. By refinancing, you may be able to secure a lower interest rate, which can help reduce the total amount you pay over the life of the loan.

Another advantage of refinancing private student loans is the ability to change your repayment terms. This can include extending the length of your loan, which can lower your monthly payments but may result in paying more in interest over time. Alternatively, you can choose to shorten the length of your loan, which can help you pay off your debt faster and potentially save money on interest.

Consolidating multiple loans into one can also simplify your repayment process. Instead of juggling multiple loans with different interest rates and payment due dates, you can combine them into one loan with a single monthly payment. This can make it easier to keep track of your loans and ensure that you do not miss any payments.

Overall, refinancing private student loans can be a smart financial move for borrowers who are looking to save money, lower their monthly payments, or simplify their repayment process. It is important to carefully consider the terms of the new loan and compare them to your existing loans to ensure that refinancing makes sense for your financial situation.

Benefits of Refinancing Private Student Loans

Refinancing private student loans can offer several benefits that can help students save money and manage their finances more effectively. One of the main advantages of refinancing is the potential to lower interest rates. By refinancing at a lower rate, borrowers can reduce their monthly payments and save money over the life of the loan.

Another benefit of refinancing private student loans is the ability to combine multiple loans into one, making it easier to manage payments and keep track of due dates. This can help simplify the repayment process and prevent missed payments, which can negatively impact credit score.

Refinancing can also provide the opportunity to switch from a variable interest rate to a fixed rate, offering stability and predictability in monthly payments. This can be especially helpful for borrowers who prefer to have a consistent payment amount each month.

Additionally, refinancing private student loans can help borrowers improve their credit score. By consolidating loans and making timely payments, borrowers can demonstrate responsible financial behavior, which can have a positive impact on their credit score over time.

Refinancing can also offer the option to extend the repayment term, which can lower monthly payments but may result in paying more interest over the life of the loan. This can be helpful for borrowers who are struggling to make payments or who want to free up cash flow for other expenses.

Overall, refinancing private student loans can provide borrowers with the opportunity to save money, simplify their finances, and improve their credit score. It is important for borrowers to carefully consider their options and choose a lender that offers favorable terms and conditions before refinancing their loans.

How to Qualify for Refinancing Private Student Loans

Refinancing private student loans can be a great way to lower your interest rate, reduce your monthly payments, or change the terms of your loan. However, not everyone is eligible for refinancing. Here are some key factors to consider when determining if you qualify for refinancing:

1. Credit Score: Lenders typically look for borrowers with a good credit score when refinancing student loans. A higher credit score demonstrates that you are a responsible borrower who is likely to repay your loan on time. While there is no specific minimum credit score required for refinancing, a score of 650 or higher is generally recommended. If your credit score is lower than that, you may still be able to qualify for refinancing, but you may not get the best interest rate.

2. Income: Lenders also consider your income when determining your eligibility for refinancing. A higher income indicates that you have the means to repay your loan, making you a lower risk borrower. While there is no specific income requirement for refinancing, most lenders prefer borrowers who have a stable job and a steady income. If you are unemployed or have a low income, you may have difficulty qualifying for refinancing.

3. Debt-to-Income Ratio: Your debt-to-income ratio is another important factor that lenders consider when evaluating your eligibility for refinancing. This ratio measures the amount of your monthly income that goes towards paying off debt. Lenders prefer borrowers with a lower debt-to-income ratio, as it indicates that you have more disposable income to put towards your student loan payments. A debt-to-income ratio of 50% or lower is generally considered good, but some lenders may accept a ratio of up to 55%. If your debt-to-income ratio is higher than that, you may have difficulty qualifying for refinancing.

4. Employment Status: Lenders want to see that you have a stable job and a steady income before they will approve you for refinancing. If you are self-employed or work part-time, you may have difficulty qualifying for refinancing. Some lenders may require borrowers to have been employed for a certain amount of time before they will consider refinancing their student loans.

5. Graduation: Most lenders require borrowers to have graduated from an eligible college or university before they will consider refinancing their student loans. Some lenders may also require borrowers to have completed their degree program before they will approve them for refinancing. If you have not yet graduated, you may have difficulty qualifying for refinancing.

Overall, qualifying for refinancing private student loans depends on a variety of factors, including your credit score, income, debt-to-income ratio, employment status, and graduation status. It is important to research different lenders and their requirements before applying for refinancing to increase your chances of approval.

Tips for Choosing a Lender to Refinance Private Student Loans

When it comes to refinancing your private student loans, choosing the right lender is crucial. With so many options available in the market, it can be overwhelming to decide which lender to go with. Here are some tips to help you choose the best lender to refinance your private student loans:

1. Compare Interest Rates: One of the most important factors to consider when choosing a lender to refinance your private student loans is the interest rate. Make sure to compare the interest rates offered by different lenders and choose the one that offers the lowest rate. A lower interest rate can save you thousands of dollars over the life of your loan.

2. Check for Fees: Before choosing a lender, it’s important to check for any fees associated with refinancing your private student loans. Some lenders may charge origination fees, application fees, or prepayment penalties. Make sure to read the fine print and understand all the fees involved before making a decision.

3. Look for Flexible Repayment Options: When choosing a lender to refinance your private student loans, look for one that offers flexible repayment options. Some lenders may offer options such as income-based repayment plans, deferment, or forbearance. These options can help you manage your payments more effectively, especially if you encounter financial difficulties.

4. Consider Customer Reviews: Before finalizing your decision, take some time to research customer reviews of the lender you are considering. You can look for reviews on websites like Trustpilot or the Better Business Bureau. Pay attention to feedback regarding customer service, ease of the application process, and overall satisfaction with the lender. Reading reviews can give you a better idea of what to expect when working with a particular lender.

5. Check the Lender’s Reputation: It’s important to choose a reputable lender when refinancing your private student loans. Look for lenders that have a good reputation in the industry and are known for their transparency and customer service. You can check the lender’s credentials and ratings with organizations like the Consumer Financial Protection Bureau or the National Association of Student Financial Aid Administrators.

By following these tips, you can choose the best lender to refinance your private student loans and save money in the long run. Don’t rush into a decision, take your time to research and compare options before making a choice. Refinancing your private student loans can help you lower your monthly payments and pay off your debt faster, so it’s essential to choose a lender that fits your needs and financial goals.

Common Mistakes to Avoid When Refinancing Private Student Loans

Refinancing private student loans can be a smart financial move for many borrowers, offering the potential to lower interest rates, reduce monthly payments, and simplify repayment. However, there are some common mistakes that borrowers should avoid when considering refinancing their loans. Here are five key mistakes to steer clear of:

1. Not Shopping Around for the Best Rate: One of the biggest mistakes borrowers make when refinancing their private student loans is not taking the time to shop around for the best rate. Different lenders offer different rates and terms, so it’s important to compare offers from multiple lenders to ensure you’re getting the best deal. Don’t just settle for the first offer you receive – explore your options and choose the loan that offers the most competitive terms.

2. Ignoring the Fine Print: Before refinancing your private student loans, make sure you carefully read and understand the terms of the new loan. Pay attention to details such as the interest rate, repayment term, fees, and any potential penalties for late payments or early repayment. It’s crucial to have a clear understanding of what you’re signing up for to avoid any surprises down the road.

3. Not Considering Your Financial Goals: Another common mistake borrowers make is refinancing their private student loans without considering their long-term financial goals. Before refinancing, take the time to think about what you want to achieve – whether it’s lowering your monthly payments, paying off your loans faster, or saving money on interest. Make sure the new loan aligns with your financial objectives to ensure you’re making a smart decision.

4. Co-Signing with an Unreliable Partner: If you’re considering refinancing your private student loans with a co-signer, make sure you choose someone who is reliable and financially responsible. Co-signing a loan is a serious commitment, and if your co-signer fails to make payments or defaults on the loan, it can have a negative impact on both of your credit scores. Before involving a co-signer, have a frank discussion about expectations, responsibilities, and the potential risks involved.

5. Rushing the Refinancing Process: One of the biggest mistakes borrowers make when refinancing their private student loans is rushing through the process. Refinancing is a significant financial decision that can have long-term consequences, so it’s important to take the time to carefully research your options, compare offers, and weigh the pros and cons of each loan. Rushing into a refinancing agreement without fully understanding the terms or considering all of your options can lead to regrets later on. Take your time, ask questions, and make an informed decision that aligns with your financial goals.

Avoiding these common mistakes can help you make a smart and informed decision when refinancing your private student loans. By taking the time to shop around, understand the terms of the loan, consider your financial goals, choose a reliable co-signer, and not rushing the process, you can set yourself up for success and potentially save money on your student loan repayments.