Refinance Student Loans Comparison

Comparing Options for Refinancing Student Loans

Hey there! So you’re thinking about refinancing your student loans, huh? It can be a daunting task with a lot of options out there, but don’t worry – we’ve got you covered. In this article, we’ll break down the different options available to you so you can make an informed decision and hopefully save some money in the process. Let’s dive in!

Types of Student Loan Refinancing Options

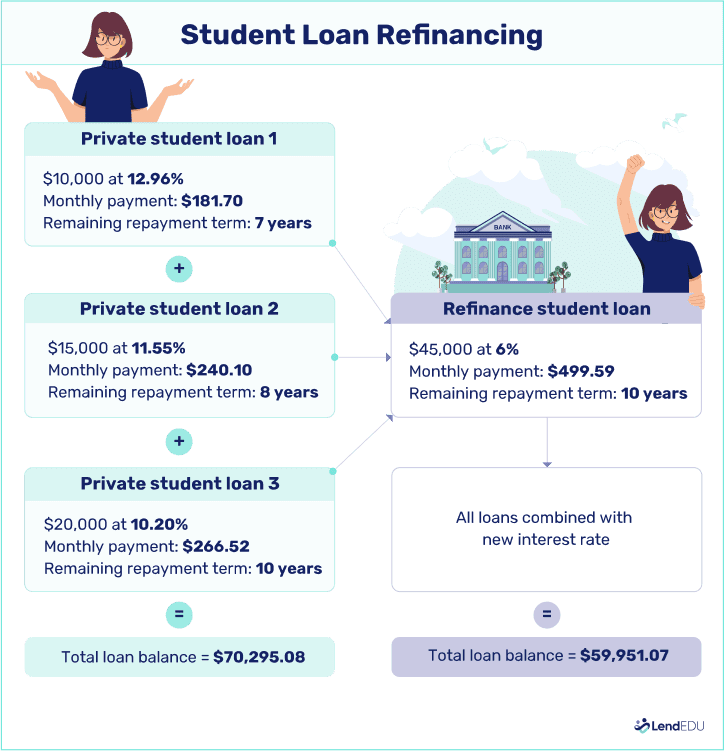

When it comes to refinancing student loans, there are several options available to borrowers. One of the main types of student loan refinancing is through a traditional lender, such as a bank or credit union. This type of refinancing involves taking out a new loan with a lower interest rate to pay off your existing student loans. By doing this, you can potentially save money on interest payments over the life of the loan.

Another option for refinancing student loans is through online lenders. Online lenders typically offer more competitive interest rates and flexible repayment terms compared to traditional lenders. This can be especially beneficial for borrowers with high student loan balances or multiple loans to refinance. Many online lenders also offer tools and resources to help borrowers compare different loan options and choose the best fit for their financial situation.

For borrowers who are looking to refinance federal student loans, one option is to consolidate them through a Direct Consolidation Loan. This type of refinancing allows borrowers to combine multiple federal student loans into one new loan with a fixed interest rate. While this can simplify the repayment process, it’s important to note that consolidating federal loans may result in the loss of certain borrower benefits, such as income-driven repayment plans or loan forgiveness programs.

Lastly, some borrowers may also consider refinancing their student loans through a credit union or non-profit organization. These types of lenders often offer lower interest rates and more personalized customer service compared to traditional banks. Additionally, credit unions and non-profits may have special programs or incentives for borrowers who meet certain eligibility criteria, such as working in a specific industry or living in a certain geographic area.

Overall, the key to finding the best student loan refinancing option is to compare rates, terms, and benefits from multiple lenders. By doing your research and understanding your financial goals, you can make an informed decision that will help you save money and pay off your student loans faster.

Pros and Cons of Refinancing Student Loans

Refinancing student loans can be a great option for borrowers looking to save money or simplify their repayment process. However, there are certain pros and cons to consider before making the decision to refinance. Here are some of the key factors to keep in mind:

Pros:

1. Lower Interest Rates: One of the biggest advantages of refinancing student loans is the potential to secure a lower interest rate. If your credit score has improved since you first borrowed your student loans or market interest rates have dropped, refinancing could save you thousands of dollars over the life of your loan.

2. Simplified Repayment: Refinancing allows borrowers to combine multiple student loans into a single loan with one monthly payment. This can make managing your debt much easier and less stressful. Additionally, some lenders offer flexible repayment terms, such as income-driven repayment plans, to better fit your financial situation.

3. Improved Credit Score: Making timely payments on a refinanced loan can help boost your credit score. A higher credit score can qualify you for better interest rates on future loans, saving you even more money in the long run.

4. Cosigner Release: If you originally needed a cosigner to qualify for your student loans, refinancing could potentially allow you to release them from their obligation. This can be beneficial for both parties, as the cosigner will no longer be responsible for your debt and you will have full control over your loan.

Cons:

1. Loss of Federal Loan Benefits: If you refinance federal student loans with a private lender, you may lose certain benefits associated with federal loans, such as income-driven repayment plans, loan forgiveness programs, and deferment options. It’s important to weigh the potential cost savings of refinancing against the loss of these benefits before making a decision.

2. Variable Interest Rates: While refinancing can sometimes result in lower interest rates, many private lenders offer variable interest rate loans. This means that your monthly payment could increase if interest rates rise in the future. Make sure to carefully consider the terms of the loan and how they may impact your finances over time.

3. Fees and Costs: Some lenders charge fees for refinancing student loans, such as origination fees or prepayment penalties. Before refinancing, be sure to calculate the total cost of the loan, including any fees, to determine if the savings outweigh the expenses.

4. Eligibility Requirements: Not all borrowers will qualify for refinancing, especially if their credit score or financial situation has deteriorated since taking out their original loans. Lenders typically require a good credit score and steady income to approve a refinanced loan, so it’s important to understand the eligibility requirements before applying.

Overall, the decision to refinance student loans should be carefully considered and based on your individual financial goals and circumstances. By weighing the pros and cons of refinancing, you can make an informed decision that best suits your needs.

How to Compare Interest Rates for Refinancing

When considering refinancing your student loans, one of the most important factors to compare is the interest rates offered by different lenders. Interest rates can have a significant impact on the total amount you will pay over the life of the loan, so it’s essential to choose a rate that works for your financial situation. Here are some tips on how to compare interest rates for refinancing:

1. Shop Around: Just like you would when shopping for any other product or service, it’s essential to shop around and compare interest rates from multiple lenders. Different lenders may offer different rates based on your credit history, income, and other factors. By comparing rates from several lenders, you can ensure that you are getting the best deal possible.

2. Consider Fixed vs. Variable Rates: When comparing interest rates for refinancing, you’ll need to decide whether you want a fixed or variable rate loan. Fixed-rate loans have a set interest rate for the life of the loan, while variable rate loans can fluctuate over time. Fixed rates offer more stability but may be higher initially, while variable rates may start lower but could increase in the future.

3. Look at the APR: When comparing interest rates, it’s essential to look at the Annual Percentage Rate (APR) in addition to the interest rate. The APR includes not only the interest rate but also any fees associated with the loan, giving you a more accurate picture of the total cost. Be sure to compare the APR from different lenders to get a better understanding of the overall cost of the loan.

4. Check for Discounts: Some lenders offer discounts on interest rates for various reasons, such as enrolling in autopay or having a certain credit score. Be sure to inquire about any potential discounts that may be available to you, as they could help lower your interest rate and save you money over the life of the loan.

5. Consider Co-Signers: If you have a co-signer with good credit, you may be able to qualify for a lower interest rate on your refinanced loan. Lenders often consider the credit history of both the primary borrower and the co-signer, so having a co-signer with excellent credit could help you secure a better rate.

By following these tips on how to compare interest rates for refinancing, you can make an informed decision and choose a loan that works best for your financial situation. Remember to shop around, consider fixed vs. variable rates, look at the APR, check for discounts, and consider using a co-signer if necessary. With careful consideration and research, you can find a refinanced loan with a competitive interest rate that helps you save money in the long run.

Factors to Consider When Choosing a Lender for Refinancing

Refinancing your student loans can be a great way to save money on interest and potentially lower your monthly payments. However, choosing the right lender is crucial to ensure that you get the best deal possible. Here are some factors to consider when selecting a lender for refinancing:

1. Interest Rates: One of the most important factors to consider when refinancing your student loans is the interest rate offered by the lender. Be sure to compare rates from multiple lenders to ensure that you are getting the best deal possible. Remember, even a small difference in interest rates can add up to significant savings over the life of your loan.

2. Fees: In addition to interest rates, it’s essential to consider any fees associated with refinancing your student loans. Some lenders may charge origination fees, application fees, or prepayment penalties. Be sure to read the fine print and understand all the fees involved before choosing a lender.

3. Repayment Terms: Another factor to consider when choosing a lender for refinancing is the repayment terms they offer. Some lenders may offer flexible repayment options, such as income-based repayment plans or interest-only payments during the grace period. Make sure to choose a lender that offers terms that align with your financial goals and needs.

4. Customer Service: When refinancing your student loans, it’s essential to choose a lender that provides excellent customer service. Dealing with student loan servicers can be frustrating, so it’s crucial to select a lender that is responsive, helpful, and easy to work with. Look for lenders that have good reviews and a reputation for providing top-notch customer service.

5. Loan Limits: Some lenders may have minimum or maximum loan limits for refinancing student loans. Be sure to check these limits before applying to ensure that the lender can accommodate the amount of debt you need to refinance. If you have a large amount of student loan debt, you may need to find a lender that can refinance the full amount.

6. Eligibility Requirements: Lastly, before choosing a lender for refinancing, make sure to check their eligibility requirements. Some lenders may have strict credit score or income requirements, while others may be more flexible. Make sure you meet the lender’s criteria before applying to increase your chances of approval.

Overall, choosing a lender for refinancing your student loans is an important decision that should not be taken lightly. By considering factors such as interest rates, fees, repayment terms, customer service, loan limits, and eligibility requirements, you can find a lender that offers the best deal for your financial situation.

Tips for Successfully Refinancing Your Student Loans

Refinancing your student loans can be a great way to save money on interest and lower your monthly payments. However, it’s important to approach the process carefully and consider all factors before making a decision. Here are some tips to help you successfully refinance your student loans:

1. Check Your Credit Score: Before applying for refinancing, it’s important to know your credit score. Lenders typically require a good credit score to qualify for the best interest rates. Check your credit score and take steps to improve it if necessary before applying for refinancing.

2. Compare Lenders: Don’t just go with the first lender you come across. Take the time to compare different lenders and their rates, terms, and conditions. Look for a lender that offers competitive interest rates, flexible repayment options, and good customer service.

3. Consider a Co-Signer: If you don’t have a strong credit history or income, consider applying for refinancing with a co-signer. A co-signer with good credit can help you qualify for better rates and terms. Just make sure the co-signer understands their obligations and risks.

4. Understand the Terms and Conditions: Before signing on the dotted line, make sure you understand all the terms and conditions of the refinancing agreement. Pay attention to the interest rate, repayment schedule, fees, and any penalties for early repayment. Make sure you are comfortable with all the terms before proceeding.

5. Create a Repayment Plan: Before refinancing, take the time to create a repayment plan that works for your financial situation. Consider factors such as your income, expenses, and goals for paying off your student loans. Look for a repayment plan that fits your budget and allows you to make timely payments each month.

6. Stay Current on Payments: Once you have refinanced your student loans, it’s important to stay current on your payments. Missing payments can negatively impact your credit score and could result in penalties from the lender. Make your payments on time each month and consider setting up automatic payments to avoid missing any deadlines.

7. Monitor Your Progress: After refinancing, keep track of your progress in paying off your student loans. Monitor your remaining balance, interest rate, and repayment schedule. Consider making extra payments when possible to pay off your loans faster and save on interest in the long run.

By following these tips, you can successfully refinance your student loans and save money in the process. Remember to carefully consider all factors and choose a refinancing option that works best for your financial situation. With the right approach, you can take control of your student loan debt and work towards a brighter financial future.