Splash Financial Refinance Student Loans

Splash Financial Offers Student Loan Refinancing Options

Hey there, folks! Looking to save some money on your student loans? Splash Financial might just have the solution for you. As a leading student loan refinancing company, Splash Financial offers a variety of options to help borrowers lower their interest rates and monthly payments. Whether you’re a recent graduate or have been out of school for a while, Splash Financial can help you find a refinancing plan that fits your needs and budget. Read on to learn more about how Splash Financial can help you take control of your student loan debt.

Understanding Student Loan Refinancing

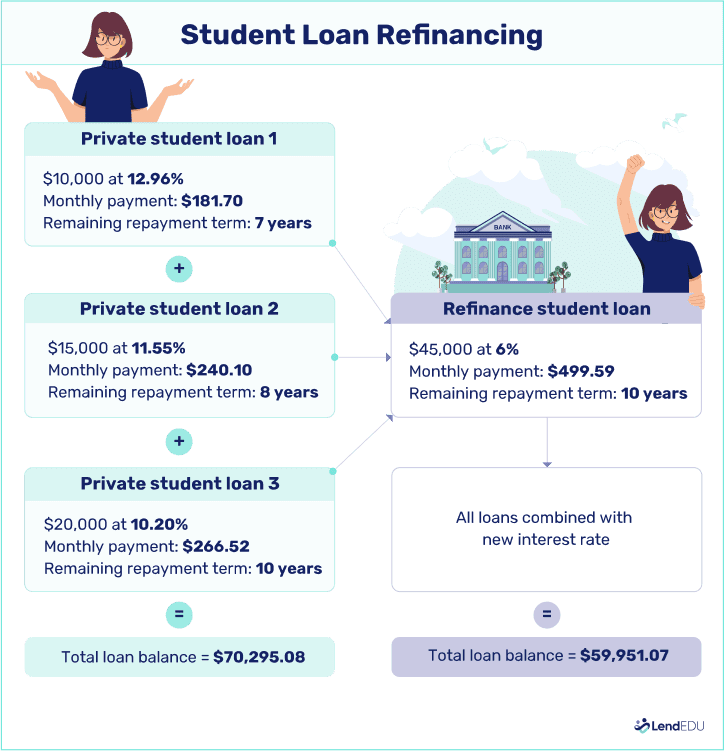

Student loan refinancing is a process where a borrower takes out a new loan to pay off their existing student loans. This new loan typically comes with a lower interest rate and different loan terms, which can help borrowers save money in the long run. When you refinance your student loans, you may be able to extend the length of your loan term, lower your monthly payments, or both. It’s important to understand the ins and outs of student loan refinancing before making a decision.

One of the main benefits of student loan refinancing is the potential to save money on interest payments. If you have a high interest rate on your current student loans, refinancing could help you secure a lower rate, which can result in significant savings over the life of the loan. Lowering your interest rate even by just a percentage point can add up to thousands of dollars in savings over the repayment period. It’s important to shop around and compare rates from different lenders to ensure you’re getting the best possible deal.

Another advantage of student loan refinancing is the ability to simplify your finances. If you have multiple student loans with different lenders, keeping track of monthly payments and due dates can be a hassle. By refinancing your loans, you can consolidate them into one loan with one monthly payment. This can help streamline your budgeting and make it easier to stay on top of your financial obligations.

Additionally, student loan refinancing can provide borrowers with the opportunity to change their loan terms. For example, if you’re struggling to make your current monthly payments, refinancing could allow you to extend the length of your loan term, which will lower your monthly payments. On the other hand, if you’re in a better financial position and want to pay off your loan faster, you could choose a shorter loan term to increase your monthly payments and save on interest.

It’s important to note that refinancing federal student loans into a private loan means losing access to federal loan benefits such as income-driven repayment plans, loan forgiveness programs, and deferment options. Before refinancing, make sure to carefully consider the trade-offs and decide if the potential savings outweigh the benefits you would be giving up.

In conclusion, student loan refinancing can be a smart financial move for borrowers looking to save money, simplify their finances, and potentially change their loan terms. However, it’s crucial to weigh the pros and cons carefully and ensure that you’re making an informed decision that aligns with your financial goals.

Benefits of Refinancing Student Loans with Splash Financial

Refinancing student loans with Splash Financial comes with a range of benefits that can help borrowers better manage their debt and save money in the long run. One of the main advantages of refinancing with Splash Financial is the ability to lower your interest rate. By refinancing at a lower interest rate, borrowers can potentially save thousands of dollars over the life of their loan. This can lead to lower monthly payments and a faster payoff timeline, allowing borrowers to become debt-free sooner.

In addition to saving money on interest, refinancing with Splash Financial can also simplify your repayment process. Instead of juggling multiple loans with varying interest rates and due dates, borrowers can consolidate their loans into a single, easy-to-manage loan with Splash Financial. This can make it easier to stay on top of payments and avoid late fees or missed payments.

Another benefit of refinancing student loans with Splash Financial is the option to choose a new repayment term. Borrowers have the flexibility to select a repayment term that works best for their financial situation, whether that’s a shorter term to pay off the loan more quickly or a longer term to lower their monthly payments. This can help borrowers better align their loan repayment with their financial goals and budget.

Furthermore, Splash Financial offers personalized customer service to help borrowers navigate the refinancing process. Their team of loan specialists can provide guidance and support every step of the way, from determining eligibility and completing the application to finalizing the refinance and making payments. This level of support can give borrowers peace of mind and confidence in their decision to refinance with Splash Financial.

Overall, refinancing student loans with Splash Financial can provide borrowers with the opportunity to save money, simplify their repayment process, choose a new repayment term, and receive personalized customer service. These benefits can help borrowers take control of their student loan debt and move towards a brighter financial future.

How to Apply for Student Loan Refinancing with Splash Financial

When it comes to refinancing your student loans with Splash Financial, the process is straightforward and user-friendly. Here’s a step-by-step guide on how to apply for student loan refinancing with Splash Financial:

1. Start by visiting the Splash Financial website and creating an account. You will need to provide basic information such as your name, email address, and password. Once your account is set up, you can begin the application process.

2. Next, you will need to input details about your current student loans, including the loan amount, interest rate, and repayment term. Splash Financial will use this information to determine if you qualify for refinancing and to provide you with personalized loan options.

3. After submitting your loan information, Splash Financial will perform a soft credit check to assess your creditworthiness. This will not impact your credit score. If you meet the eligibility requirements, you will be presented with refinancing options tailored to your financial situation.

4. Review the loan offers provided by Splash Financial and select the one that best fits your needs. Pay attention to factors such as the interest rate, repayment term, and monthly payment amount. Make sure to read the terms and conditions carefully before accepting the loan offer.

5. Once you have chosen a loan offer, you will need to submit additional documentation to complete the refinancing process. This may include proof of income, government-issued identification, and verification of your current student loans. Splash Financial may also require you to e-sign certain documents.

6. After reviewing your submitted documents, Splash Financial will finalize your loan application and work with their network of lending partners to secure the refinancing loan. Once the loan is approved, any existing student loans you have chosen to refinance will be paid off, and you will begin making payments on your new loan.

7. Keep in mind that the timeline for refinancing your student loans with Splash Financial can vary depending on factors such as the complexity of your financial situation and the responsiveness of your loan servicers. Be sure to stay in touch with Splash Financial throughout the process to ensure a smooth refinancing experience.

By following these steps, you can successfully apply for student loan refinancing with Splash Financial and potentially lower your interest rate, reduce your monthly payments, and streamline your debt repayment process.

Common Questions about Refinancing Student Loans

Refinancing student loans can be a great way to save money and simplify your finances. However, it’s important to understand the process and what it entails before making a decision. Here are some common questions about refinancing student loans:

1. What is student loan refinancing?

Student loan refinancing is the process of taking out a new loan to pay off existing student loans. This new loan typically has a lower interest rate, which can save you money over the life of the loan. Refinancing can also help you consolidate multiple loans into one, making it easier to manage your debt.

2. How do I qualify for student loan refinancing?

To qualify for student loan refinancing, you typically need a good credit score and a stable income. Lenders will also look at your debt-to-income ratio and employment history. If you don’t meet the qualifications on your own, you may be able to apply with a cosigner who does.

3. Can I refinance federal student loans?

Yes, you can refinance federal student loans through a private lender. However, it’s important to understand that by refinancing federal loans, you will lose access to federal loan benefits such as income-driven repayment plans and loan forgiveness programs. Make sure to weigh the pros and cons before refinancing federal loans.

4. How do I choose the best lender for student loan refinancing?

When choosing a lender for student loan refinancing, it’s important to consider a few key factors. First, compare interest rates from multiple lenders to find the best offer. Look for lenders that offer flexible repayment options and good customer service. You’ll also want to consider the lender’s reputation and any fees associated with the loan.

Another important factor to consider is whether the lender offers any borrower protections, such as the ability to defer payments in case of financial hardship. It’s also a good idea to check if the lender offers any bonuses or discounts for refinancing with them, such as an interest rate reduction for setting up autopay.

Ultimately, the best lender for student loan refinancing will depend on your individual financial situation and needs. Take the time to research different lenders and compare offers before making a decision. Refinancing student loans can be a smart financial move, but it’s important to choose the right lender for your specific circumstances.

Why Splash Financial is a Top Choice for Refinancing Student Loans

Refinancing student loans can be a daunting task, but Splash Financial makes it easy and seamless for borrowers looking to save money and reduce their monthly payments. Here are five reasons why Splash Financial stands out as a top choice for refinancing student loans:

1. Competitive Rates: One of the most attractive features of Splash Financial is their competitive interest rates. By refinancing with Splash, borrowers have the opportunity to lock in a lower interest rate, ultimately saving them money over the life of the loan. With interest rates at historic lows, now is the perfect time to refinance and take advantage of the savings offered by Splash Financial.

2. Flexible Repayment Options: Splash Financial offers a variety of repayment options to cater to each borrower’s unique financial situation. Whether you are looking to lower your monthly payments or pay off your loan faster, Splash Financial has a repayment plan that will fit your needs. Plus, borrowers have the option to choose between fixed or variable interest rates, giving them even more flexibility when refinancing.

3. Streamlined Application Process: Refinancing student loans can often be a time-consuming and complex process, but Splash Financial has simplified it with their streamlined application process. With just a few clicks, borrowers can easily apply for refinancing online and receive a decision within minutes. This makes the process quick and hassle-free, allowing borrowers to start saving money sooner.

4. Excellent Customer Service: Splash Financial prides itself on providing excellent customer service to all borrowers. Their knowledgeable team is available to answer any questions and guide borrowers through the refinancing process. Whether you are a first-time borrower or have refinanced before, Splash Financial’s team of experts will ensure that you have a positive experience from start to finish.

5. Additional Benefits: In addition to competitive rates, flexible repayment options, and excellent customer service, Splash Financial offers a range of additional benefits to borrowers. These benefits may include autopay discounts, no application fees, and the ability to refinance both federal and private student loans. By refinancing with Splash Financial, borrowers have the opportunity to save money and simplify their loan repayment process.

Originally posted 2025-10-13 04:36:30.