Top Student Loan Rates

Top Student Loan Rates: Finding the Best Options for Your Education

Welcome to our guide on finding the top student loan rates to help you finance your education. As a student, navigating the world of loans can be overwhelming, but we’re here to make it easier for you. By comparing and contrasting different loan options, you can find the best rates that suit your needs and budget. Let’s explore the possibilities together and ensure you make informed decisions about your financial future.

Understanding Student Loan Interest Rates

When it comes to student loans, understanding interest rates is crucial. Interest rates determine how much extra you’ll pay on top of the principal amount borrowed. The lower the interest rate, the less you will end up paying back in total. Essentially, interest rates are the cost of borrowing money from a lender. The interest rate is expressed as a percentage of the principal loan amount. For example, if you have a loan with a 5% interest rate on a $10,000 loan, you would pay $500 in interest each year.

Student loan interest rates can be either fixed or variable. Fixed interest rates remain the same throughout the life of the loan, while variable interest rates can fluctuate based on market conditions. Fixed interest rates provide stability and predictability, as your monthly payments will always remain the same. On the other hand, variable interest rates may start lower than fixed rates but can increase over time, leading to unpredictable payments.

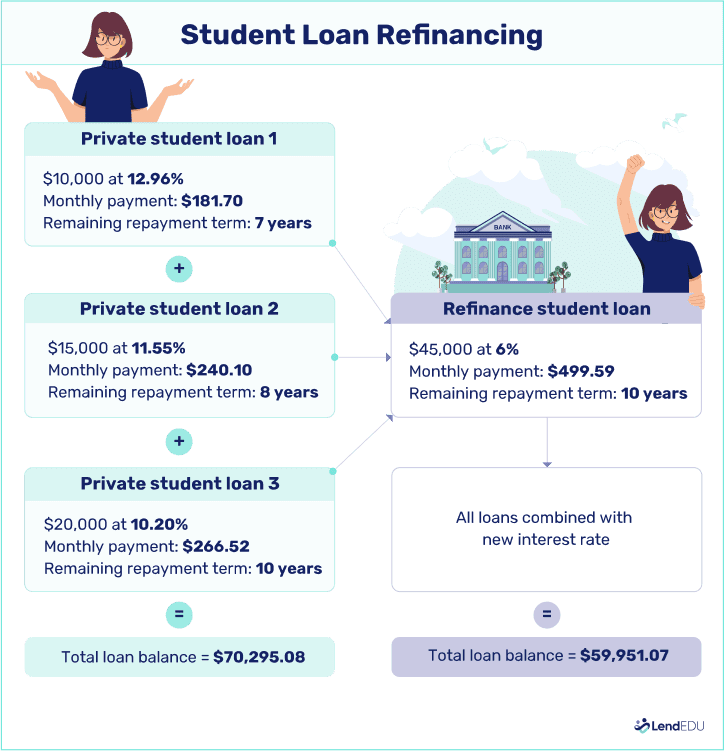

It’s important to note that federal student loans typically have lower interest rates compared to private student loans. This is because federal loans are backed by the government, making them less risky for lenders. Private student loans, on the other hand, are offered by banks, credit unions, and online lenders, and typically have higher interest rates to compensate for the increased risk.

When shopping for student loans, it’s essential to compare interest rates from different lenders. Even a small difference in interest rates can add up to significant savings over the life of the loan. Consider factors such as the loan term, repayment options, and any potential fees associated with the loan. Some lenders offer discounts on interest rates for setting up automatic payments or for having good grades.

Another essential concept to understand is the difference between simple interest and compound interest. Simple interest is calculated only on the principal amount borrowed, while compound interest is calculated on the principal amount plus any accrued interest. For student loans, compound interest can lead to significantly higher costs over time, so it’s important to understand how interest is calculated on your loan.

In conclusion, understanding student loan interest rates is essential for making informed decisions about borrowing money for college. By comparing interest rates, loan terms, and repayment options, you can save money and choose the best loan for your financial situation. Remember to consider whether a fixed or variable interest rate is right for you and be aware of the impact of compound interest on the total cost of your loan.

Researching the Best Student Loan Rates

When researching the best student loan rates, there are a few key factors to consider to ensure you are getting the most affordable option for your education expenses. One of the first steps is to compare rates from different lenders to see what each one offers. This can be done online through various websites that specialize in student loans, or by contacting individual financial institutions directly.

It’s important to keep in mind that the interest rates offered by lenders can vary based on a number of factors, including the type of loan, your credit score, and whether or not you have a cosigner. For example, federal student loans typically have fixed interest rates that are set by the government, while private lenders may offer both fixed and variable rates that can change over time.

Another important aspect to research is the repayment terms associated with the loan rates you are considering. Some lenders may offer more flexible repayment options, such as income-driven repayment plans or deferment for hardship situations. It’s important to understand these terms upfront so you can make an informed decision about which loan option is right for you.

In addition to interest rates and repayment terms, it’s also a good idea to research any fees associated with the student loan. Some lenders may charge origination fees or require a down payment, which can add to the overall cost of the loan. By comparing these fees among different lenders, you can better understand the total cost of borrowing and make a more informed decision.

Lastly, don’t forget to consider the reputation and customer service of the lender when researching student loan rates. It’s important to choose a lender that is trustworthy and responsive to your needs, especially when it comes to managing your loan throughout the repayment process. Reading reviews and talking to other borrowers can give you a sense of what to expect from each lender before making a commitment.

Factors that Impact Student Loan Rates

When it comes to student loan rates, there are several factors that can influence the interest rate you receive on your loan. Understanding these factors can help you make informed decisions about your student loans and potentially save money in the long run.

1. Credit Score: One of the biggest factors that impact student loan rates is your credit score. Lenders use your credit score to determine how risky it is to lend you money. Generally, the higher your credit score, the lower your interest rate will be. If you have a low credit score, you may end up paying a higher interest rate on your student loans.

2. Type of Loan: The type of loan you choose can also affect the interest rate you receive. Federal student loans typically have fixed interest rates, which means that your rate will stay the same for the life of the loan. Private student loans, on the other hand, may have variable interest rates that can change over time. It’s important to carefully consider the type of loan that will work best for your financial situation.

3. Loan Term: The length of your loan term can also impact the interest rate you receive. In general, shorter loan terms tend to have lower interest rates than longer loan terms. This is because lenders view shorter loan terms as less risky, since there is less time for something to go wrong with the loan. On the other hand, longer loan terms may come with higher interest rates to offset the increased risk to the lender. It’s important to consider your financial goals and ability to repay the loan when choosing a loan term.

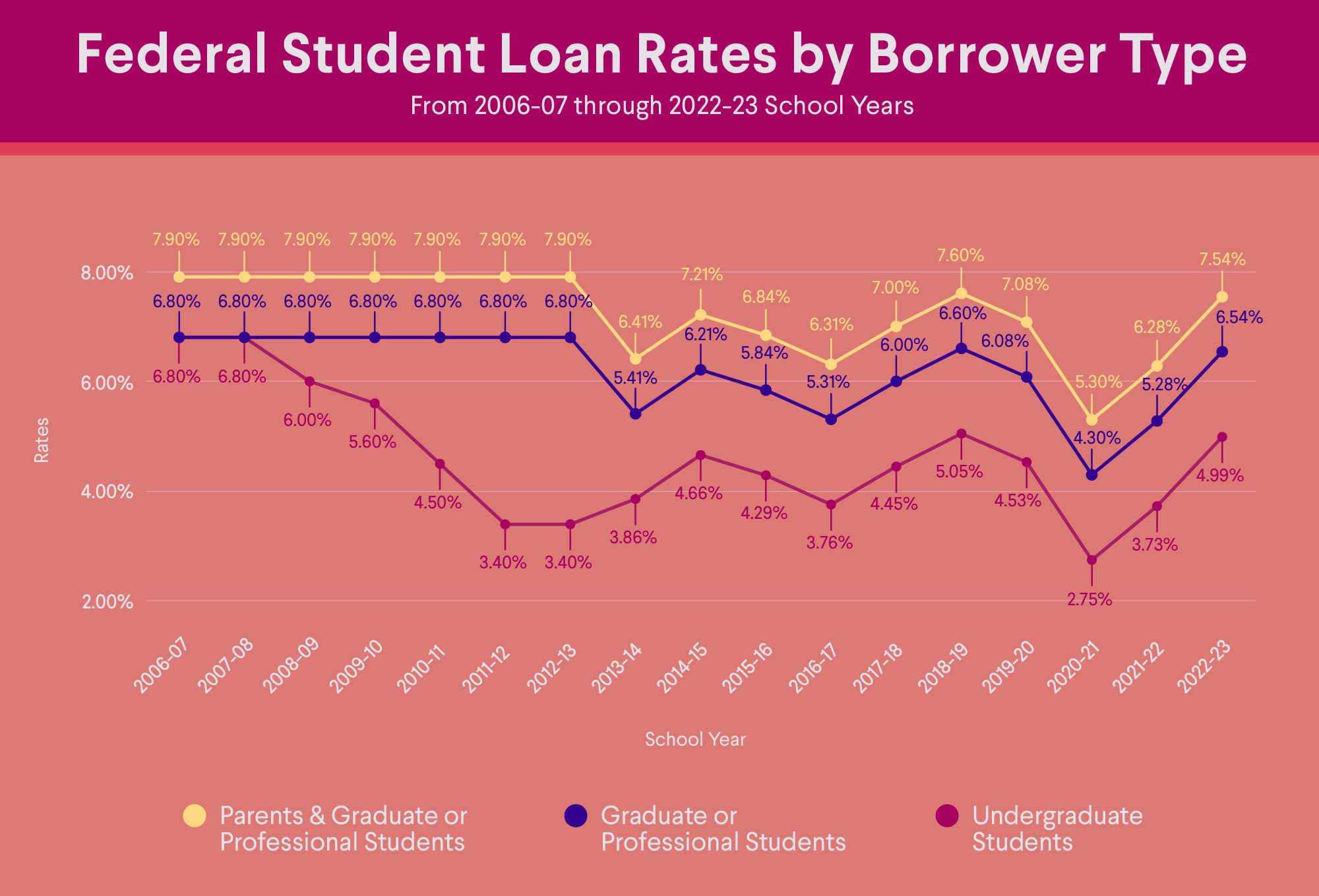

4. Market Conditions: The overall economic climate can also affect student loan rates. When interest rates are low, you may be able to secure a lower rate on your student loans. Conversely, when interest rates are high, you may end up paying more in interest over the life of your loan. Keeping an eye on market conditions can help you time your loan applications to take advantage of lower rates.

5. Co-signer: If you have a co-signer on your student loan, their credit score and financial history can also impact the interest rate you receive. A co-signer with a strong credit history can help you secure a lower interest rate, while a co-signer with a poor credit history may result in a higher rate. It’s important to carefully consider who you choose as a co-signer and their financial situation before applying for a loan.

By understanding the factors that impact student loan rates, you can make smarter decisions about your loans and potentially save money in the long run. Whether it’s improving your credit score, choosing the right type of loan, or keeping an eye on market conditions, there are steps you can take to secure the best possible interest rate on your student loans.

How to Compare Student Loan Rates from Various Lenders

When it comes to choosing the best student loan rates, it’s important to compare offers from various lenders to ensure you’re getting the most favorable terms. Here are some tips on how to effectively compare student loan rates:

1. Research Different Lenders: Start by researching different lenders that offer student loans. Look at banks, credit unions, online lenders, and even government-backed loans to see what options are available to you. Each lender may have different rates, terms, and eligibility requirements, so it’s important to explore all your options.

2. Check Interest Rates: The interest rate is one of the most important factors to consider when comparing student loan offers. A lower interest rate means you’ll pay less over the life of the loan. Make sure to compare both fixed and variable interest rates and understand how they can impact your monthly payments and overall cost of the loan.

3. Compare Fees: In addition to interest rates, be sure to compare any fees associated with the student loan. These can include origination fees, application fees, and late payment fees. Some lenders may offer loans with no fees, while others may have several fees that can add to the total cost of your loan.

4. Evaluate Repayment Options: When comparing student loan rates, it’s also important to consider the repayment options offered by each lender. Some lenders may offer flexible repayment terms, such as income-driven repayment plans or loan forgiveness programs. These options can make it easier for you to manage your student loan debt in the future.

5. Consider Customer Service: Finally, don’t forget to consider the customer service reputation of each lender. You’ll want to choose a lender that is responsive to your needs and can provide assistance if you run into any issues with your loan. Check online reviews and ask for recommendations from other borrowers to gauge the level of customer service provided by each lender.

By following these tips and thoroughly comparing student loan rates from various lenders, you can make an informed decision that will set you up for success in managing your student loan debt.

Tips for Securing the Best Student Loan Rates

Securing the best student loan rates is essential for minimizing the financial burden of borrowing money for education. Here are some tips to help you secure the best rates possible:

1. Improve Your Credit Score: One of the most important factors that lenders consider when determining your loan rate is your credit score. A higher credit score typically leads to lower interest rates. To improve your credit score, make sure to pay your bills on time, keep your credit card balances low, and avoid opening too many new credit accounts.

2. Shop Around: Just like with any other financial product, it’s crucial to shop around and compare rates from different lenders before committing to a student loan. Different lenders may offer different rates and terms, so taking the time to research and compare can save you money in the long run.

3. Consider a Cosigner: If you have a limited credit history or a lower credit score, having a cosigner with a strong credit history can help you qualify for a lower interest rate. Just make sure that your cosigner understands the responsibilities involved and is willing to take on the risk of being a guarantor for your loan.

4. Opt for Federal Student Loans First: Federal student loans typically come with lower interest rates and more flexible repayment options compared to private loans. Before considering private student loans, make sure to exhaust all federal loan options first to secure the best rates possible.

5. Maintain a Stable Income: Lenders also consider your income and employment status when determining your loan rate. Having a stable income and steady employment history can help you qualify for lower rates. If you’re still in school, consider working part-time or during the summers to demonstrate a stable source of income to potential lenders.

By following these tips and taking the time to research and compare different loan options, you can increase your chances of securing the best student loan rates. Remember that even a small difference in interest rates can add up to significant savings over the life of your loan, so it’s worth the effort to find the best rate possible.