Will Refinancing Student Loans Hurt Credit

Will Refinancing Student Loans Hurt Credit?

Hey there! If you’re considering refinancing your student loans but are worried about the impact it could have on your credit score, you’re not alone. It’s a common concern among borrowers looking to save money and lower their monthly payments. Let’s take a closer look at whether refinancing student loans could potentially hurt your credit and what you need to know before making a decision.

Understanding Credit and Student Loan Refinancing

When it comes to managing your finances, understanding credit is crucial. Your credit score is a number that represents your creditworthiness, and it is used by lenders to determine how likely you are to repay debt. A higher credit score indicates that you are a responsible borrower, while a lower credit score suggests that you may be a riskier borrower. Factors that can impact your credit score include payment history, amounts owed, length of credit history, new credit, and types of credit used.

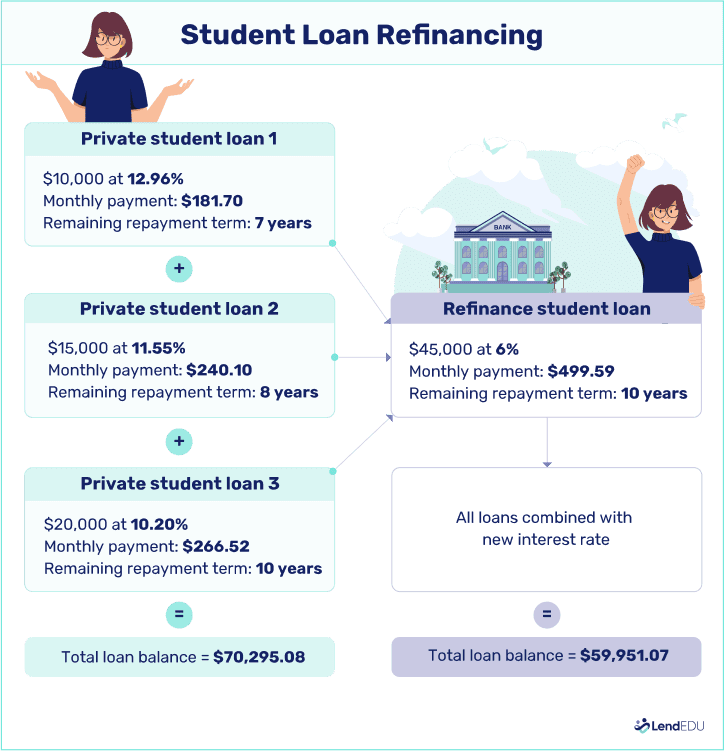

Student loan refinancing is a way for borrowers to potentially lower their interest rates and monthly payments by taking out a new loan to pay off existing student loans. This can be a valuable tool for individuals looking to save money and pay off their debt faster. However, it’s important to understand how student loan refinancing can impact your credit.

When you refinance your student loans, the lender will perform a hard credit inquiry, which can temporarily lower your credit score. This is because each hard inquiry can shave a few points off your score. However, the impact is usually minimal and should only be temporary. It’s important to note that making on-time payments on your new refinanced loan can help improve your credit over time.

Another factor to consider is your credit utilization ratio, which is the amount of credit you are using compared to the amount of credit available to you. When you refinance your student loans, you are essentially closing out old accounts and opening a new one. This can affect your credit utilization ratio, which can also impact your credit score. It’s important to be mindful of this and try to keep your credit utilization ratio low by not maxing out your new refinanced loan.

Overall, while refinancing student loans may have a temporary impact on your credit score, the long-term benefits of potentially lower interest rates and monthly payments can outweigh this. It’s important to weigh the pros and cons and make an informed decision based on your financial goals. Remember to continue making on-time payments and monitor your credit score regularly to ensure you are on the right track towards financial stability.

Impact of Student Loan Refinancing on Credit Score

When it comes to refinancing student loans, one common concern among borrowers is how it will affect their credit score. Fortunately, the impact of refinancing on credit score can vary depending on individual financial situations.

Initially, the act of applying for a student loan refinance may result in a temporary dip in your credit score. This is because the lender will likely conduct a hard inquiry on your credit report to assess your creditworthiness. Hard inquiries can cause a slight decrease in your score, but the impact is typically minimal and short-lived. It’s important to note that the negative effect of a hard inquiry is usually outweighed by the potential benefits of refinancing, such as lower interest rates and monthly payments.

If you are approved for a student loan refinance, the impact on your credit score can actually be positive in the long run. By refinancing your loans, you may be able to lower your monthly payments and pay off your debt more efficiently. This can demonstrate to creditors that you are a responsible borrower who is able to manage your finances effectively, which can have a positive impact on your credit score.

Additionally, consolidating multiple student loans into one refinanced loan can simplify your debt repayment process. This can help you avoid missing payments or becoming overwhelmed by multiple due dates, which can help you maintain a good credit score. Making on-time payments on your refinanced loan will show creditors that you are reliable and can be trusted to repay your debts, which can further boost your credit score over time.

It’s also important to consider how refinancing can affect your credit utilization ratio. Your credit utilization ratio is the amount of available credit you are using, and it is an important factor in determining your credit score. By consolidating your student loans and potentially lowering your interest rates, you may be able to reduce your overall debt burden and improve your credit utilization ratio. This can have a positive impact on your credit score and demonstrate to creditors that you are managing your debt responsibly.

In conclusion, while refinancing student loans may initially cause a small dip in your credit score due to a hard inquiry, the long-term impact can be positive. By refinancing, you may be able to lower your monthly payments, simplify your debt repayment process, and improve your credit utilization ratio. Making timely payments on your refinanced loan can demonstrate to creditors that you are a responsible borrower, which can ultimately help boost your credit score over time.

Factors that Determine the Effect on Credit Score

When it comes to refinancing student loans, many borrowers are concerned about how it will impact their credit score. While there is no one-size-fits-all answer, there are several factors that can determine the effect on your credit score.

1. Payment History: One of the most important factors that lenders consider when assessing your creditworthiness is your payment history. If you have a history of making on-time payments on your student loans, refinancing may actually improve your credit score. This is because refinancing can result in a lower interest rate or monthly payment, making it easier for you to stay current on your loan payments.

2. Credit Utilization: Another factor that can influence your credit score is your credit utilization ratio, which is the amount of credit you are using compared to the total amount of credit available to you. When you refinance your student loans, you may be opening a new line of credit, which could initially cause your credit utilization ratio to increase. However, if you are able to pay off your student loans more quickly or at a lower interest rate, this could ultimately lower your credit utilization ratio and have a positive impact on your credit score.

3. Length of Credit History: The length of your credit history is another important factor that can determine the effect of refinancing on your credit score. If you have been making on-time payments on your student loans for several years, refinancing could potentially shorten the length of your credit history. This is because when you refinance, your old student loans are paid off and a new loan is created. While this may temporarily lower your credit score, the impact is usually minimal and can be offset by other factors, such as a lower interest rate or improved payment terms.

4. Credit Inquiries: Whenever you apply for a new loan or line of credit, the lender will typically do a hard inquiry on your credit report. These inquiries can have a temporary negative impact on your credit score. However, if you shop around for the best refinancing options within a short period of time, the credit bureaus may recognize these inquiries as rate shopping and treat them as a single inquiry, minimizing the impact on your credit score.

5. Debt-to-Income Ratio: Your debt-to-income ratio is another important factor that lenders consider when evaluating your creditworthiness. Refinancing your student loans can potentially lower your monthly payments, thereby improving your debt-to-income ratio. This can have a positive impact on your credit score and make you a more attractive borrower to lenders.

Overall, while there are several factors that can determine the effect of refinancing student loans on your credit score, it is important to weigh the potential benefits against any potential drawbacks. By understanding these factors and carefully considering your options, you can make an informed decision that is in your best financial interest.

How to Limit Negative Effects on Credit When Refinancing

When refinancing student loans, it is important to understand how it can impact your credit score. While refinancing can potentially have negative effects on your credit, there are steps you can take to limit these effects and maintain a healthy credit score.

Here are some tips on how to minimize the impact on your credit when refinancing student loans:

1. Apply for multiple quotes within a short period of time: When you apply for refinancing, lenders will typically conduct a hard credit inquiry, which can temporarily lower your credit score. However, if you apply for multiple quotes within a short period of time (usually within 30 days), credit bureaus will recognize that you are rate shopping and treat it as a single inquiry, minimizing the impact on your credit.

2. Maintain current loan payments until refinancing is finalized: It is important to continue making payments on your current student loans until the refinancing process is completed. Missing payments or defaulting on your loans can have a significant negative impact on your credit score.

3. Choose a lender that reports to credit bureaus: When refinancing, make sure to choose a lender that reports your new loan to credit bureaus. Timely payments on your refinanced loan will help build positive credit history and improve your credit score over time.

4. Consider a co-signer: If you have a limited credit history or a low credit score, applying for refinancing with a co-signer can help you secure a lower interest rate and better loan terms. However, it is important to choose a co-signer with a strong credit history and the ability to make payments if you are unable to do so.

By following these tips, you can minimize the negative effects on your credit when refinancing student loans and work towards improving your overall financial health. Remember to carefully review the terms and conditions of any new loan before refinancing and make sure it aligns with your financial goals.

Improving Credit Score After Refinancing Student Loans

Refinancing student loans can have a positive impact on your credit score in the long run. By consolidating multiple loans into one, you may see an initial dip in your credit score due to the hard inquiry and the new account opening. However, this dip is usually temporary and can be offset by taking certain steps to improve your credit score post-refinancing.

One way to improve your credit score after refinancing student loans is to make on-time payments consistently. Your payment history makes up a significant portion of your credit score, so it is crucial to ensure that you pay your bills on time every month. Setting up automatic payments or reminders can help you stay on track and avoid any missed or late payments.

Additionally, reducing your credit utilization ratio can also help improve your credit score. The credit utilization ratio is the amount of credit you are using compared to the amount available to you. By paying down your remaining loan balances, you can lower your credit utilization ratio, which can have a positive impact on your credit score.

Another way to boost your credit score after refinancing student loans is to monitor your credit report regularly. Check your credit report for any errors or inaccuracies that could be negatively impacting your score. Dispute any discrepancies with the credit bureaus and follow up to ensure that they are corrected promptly. By staying proactive and vigilant about your credit report, you can ensure that your credit score accurately reflects your creditworthiness.

Furthermore, consider diversifying your credit mix to improve your credit score post-refinancing. Having a healthy mix of credit accounts, such as credit cards, auto loans, and mortgage loans, can show lenders that you can manage various types of credit responsibly. If you do not already have a mix of credit accounts, consider opening a new credit card or loan account, but be sure to use it responsibly to avoid accumulating unnecessary debt.

Lastly, be patient and give yourself time to see the positive impact of refinancing student loans on your credit score. Building good credit takes time and consistent effort, so do not be discouraged if you do not see immediate results. By following these tips and practicing good financial habits, you can gradually improve your credit score after refinancing student loans and set yourself up for future financial success.

Originally posted 2025-10-13 04:38:34.